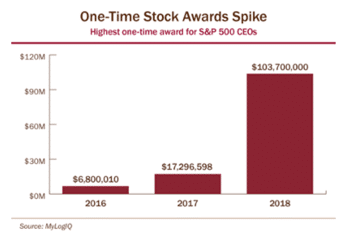

Will Upswing in One-Time Stock Awards Crumble?

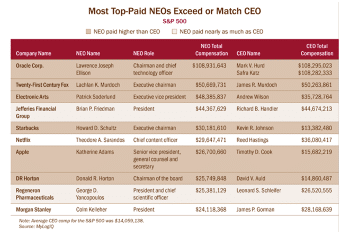

One-time stock awards for CEOs in fiscal year 2018 are up, compared to the previous two years. According to data from analytics firm MyLogIQ, in 2018, the largest one-time stock awards in the S&P 500 went to Oracle’s co-CEOs Safra Catz and Mark Hurd, each of whom received special awards of nearly $104 million — almost seven times the next-largest…